The European Commission is taking France and Luxembourg to court for applying reduced tax rates on the sale of electronic books, which the EU executive says breaks current EU rules.

The European Commission is taking France and Luxembourg to court for applying reduced tax rates on the sale of electronic books, which the EU executive says breaks current EU rules.

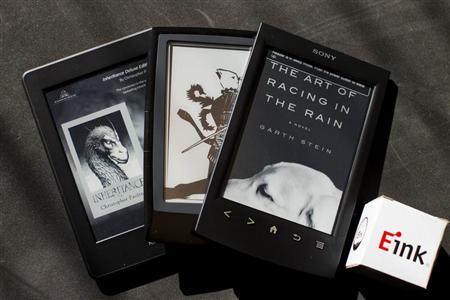

Since January 2012, France and Luxembourg have applied reduced value added tax (VAT) rates to the sale of e-books of 7 percent and 3 percent respectively. Under EU rules, governments can apply reduced VAT rates to a limited list of goods and services which includes books, but currently not e-books.

“Failure to comply with this legislation by France and Luxembourg results in serious distortions of competition to the detriment of traders from other EU member states,” the Commission said in a statement on Thursday.

The Commission has said similar goods and services should be subject to the same tax rates and that technological advances should be taken into account, but legislative proposals under a new VAT strategy are only expected by the end of 2013.

Rules on VAT on e-services that take effect from 2015 will end the unequal treatment of e-books and paper books, the Commission said.

Digital publications such as e-books are designed to be read on mobile and other electronic devices, such as Amazon’s Kindle or Apple Inc’s iPad.

If the court rules that the two countries have contravened EU law, it could ultimately lead to the imposition of fines.

Source : Reuters