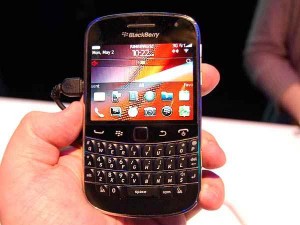

Research In Motion Ltd stock slumped again on Wednesday, even as the company said it was close to hiring a marketing boss to fashion a unified message for the next-generation BlackBerry that will likely determine its future.

Research In Motion Ltd stock slumped again on Wednesday, even as the company said it was close to hiring a marketing boss to fashion a unified message for the next-generation BlackBerry that will likely determine its future.

Speaking at an annual showcase event that has fallen flat this year, RIM Chief Executive Thorsten Heins admitted RIM spoke with more than one voice when it marketed its current BlackBerry 7 smartphones and its PlayBook tablet. He said that would change.

The Canadian company is counting on its new BlackBerry 10 platform to reverse a deep erosion in its market share as consumers and professional customers alike flock to flashier devices made by Apple Inc or powered by Google’s Android.

“One thing that really became obvious when I looked at the various parts of the company is that we needed focus,” Heins said at the BlackBerry World conference in Orlando, Florida. He took over from longtime co-CEOs Mike Lazaridis and Jim Balsillie earlier this year.

RIM stock had fallen almost 6 percent on Tuesday after the company gave investors a glimpse of its next-generation smartphones and the tools they would need to create apps for the gadgets.

But RIM has provided few details on how it plans to recover from its prolonged slump, and its shares were down another 5.3 percent by early afternoon on Wednesday, extending a slide of more than 75 percent in the past 13 months.

At the news conference, attended by about 100 journalists and bloggers, an animated Heins tried to strike a balance between acknowledging where RIM had made mistakes and pointing to his plans to get back in the game without being specific.

“These are baby steps,” said John Stephenson, senior vice president at First Asset Investment Management Inc in Toronto.

“The problem the company has is it’s not transformational. Thorsten Heins is not the transformational leader that they’re looking for. He’s probably a good manager and an improvement from what they had before with the co-CEO roles, but none of this is enough to get this thing going.”

Asked about the fall in the stock price, Stephenson added: “It’s certainly inexpensive, but the only reason to buy it today would be if your view is that they’re going to come up with a plan to split up the company in some form.”

DEARTH OF DETAILS

In March Heins said all strategic options – from licensing deals to joint ventures, partnerships and even a sale – were on the table for RIM, which had just reported its first quarterly loss in seven years.

Last month sources close to the matter said former co-CEO Balsillie had worked for months on a radical shift in RIM’s strategy that would have offered to allow rival devices such as the iPhone to use its proprietary network, including its popular BlackBerry Messenger chat program.

While giving away little about the strategic review, Heins said on Wednesday that persuading other handset makers to adopt the BlackBerry 10 platform was not an immediate priority.

“In terms of devices, there’s no decision being made,” he said. “We’re investigating our various options.”

Such a deal would boost BlackBerry 10’s attractiveness to developers, who have shied away from writing programs from RIM’s legacy platform partly in fear that BlackBerry’s stake in the market will keep shrinking.

YAWNING APP GAP

Impressing developers is crucial for RIM, which has expanded beyond its traditional strength in providing mobile email to office workers, only to struggle against the more consumer-friendly iPhone from Apple and devices that make use of the Android platform.

Waterloo, Ontario-based RIM has around 15,000 apps for its PlayBook tablet and 70,000 apps for its smartphones or the tablet, compared with 200,000 iPad apps, and half a million for the iPhone.

A new marketing chief will replace Keith Pardy, who left the company last March, just before RIM launched the PlayBook, a iPad competitor that has sold poorly.

As well, RIM needs a new chief operating officer and a chief technology officer, positions that Heins aims to fill soon.

The BlackBerry 7 line, launched late last year and equipped with RIM’s legacy operating system, is bridging the gap until RIM can launch BlackBerry 10 later this year.

Shares of RIM were down 5.3 percent at C$12.58 on Wednesday on the Toronto Stock Exchange. Its Nasdaq-listed shares were down 5.6 percent at $12.73.

Source : Reuters