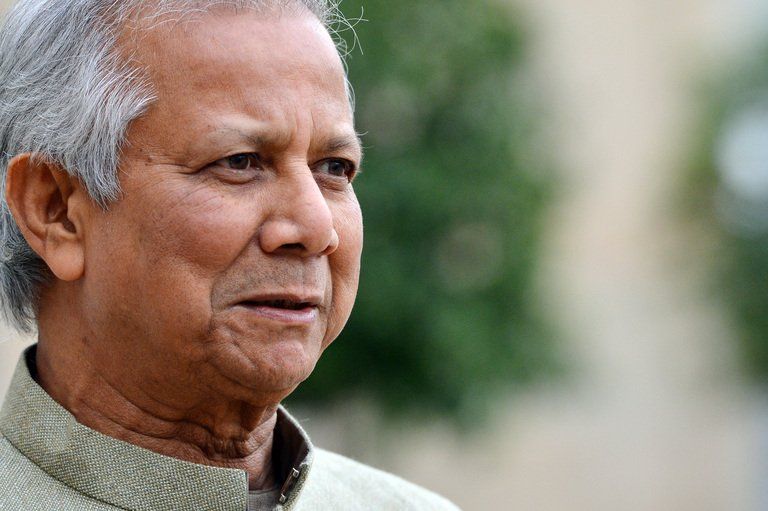

Bangladesh passed a law bringing the pioneering Grameen Bank under closer central bank supervision, a move bitterly opposed by its founder Nobel laureate Muhammad Yunus who warns of a government takeover of an institution lauded for alleviating poverty.

Grameen was a trail blazer in extending small loans to the poor denied access to regular bank credit, earning it and Yunus the 2006 Nobel Peace Prize. It has about 9 million borrowers, mostly women, who use the loans to start or expand small businesses. But Yunus and the government have been at odds for several years over the running of the bank and Yunus’ failed effort to launch a political party when Bangladesh was under a state of emergency in 2006-2008.

The law was passed late Tuesday with a voice vote in parliament after getting approval last month by the Cabinet of Prime Minister Sheikh Hasina who has frosty relations with Yunus.

A government-led investigation found that Grameen Bank violated its charter as a microlender by creating affiliates that did not benefit the bank’s shareholders.

Yunus was ousted as managing director in 2011 after the High Court ruled the 73-year-old violated retirement laws by serving beyond the age of 60. He has repeatedly accused the government of trying to “destroy” the bank, but authorities deny the allegations.

In a statement Wednesday, Yunus said a “great global iconic institution” was being brutalized by the government.

“Grameen Bank was created as a bank owned by poor women, and managed by poor women. Its legal structure did not allow any government interference of any kind, except for regulatory oversight,” he said.

Finance Minister A.M.A. Muhith has pledged that Grameen would be better run in the absence of Yunus.

The new law gives Bangladesh Bank broad powers over Grameen that are similar to the central bank’s authority over regular banks.

From now on Grameen must consult with the government over any major policy decision. Its 12-member board previously enjoyed broad authority to run Grameen. The legislation also specifies 60 as the retirement age for Grameen’s managing director and requires the bank to be audited regularly and the audit reports submitted to parliament.

The law permits Grameen to increase its capital while the government’s share of 25 percent remains unchanged. Borrowers will own 75 percent of the bank as before.

It has not increased the number of directors — three appointed by the government and the rest by shareholders. The tenure of directors will be three years while previously there was no limit.

In September, the government accused Yunus of evading tax on overseas income, including from book royalties, speeches at conferences and numerous awards. Yunus says he has always acted lawfully. His supporters say the allegations are politically motivated.

@rrajowan / Source : Associated Press