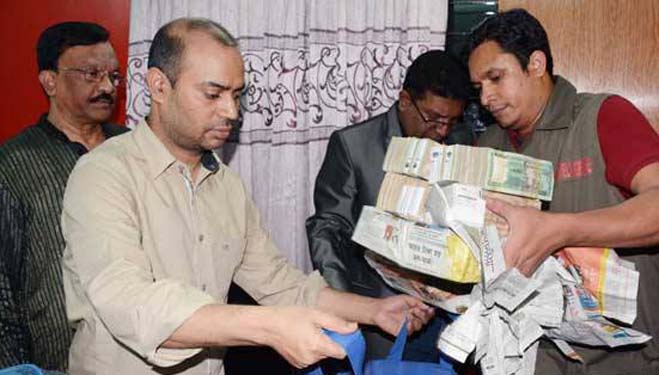

Bangladesh Insurance Association (BIA) is going to send letters to 14 insurance companies to float initial public offerings (IPO) as soon as possible as they have not yet applied to Securities and Exchange Commission (SEC) even after getting nod from the ministry.

Bangladesh Insurance Association (BIA) is going to send letters to 14 insurance companies to float initial public offerings (IPO) as soon as possible as they have not yet applied to Securities and Exchange Commission (SEC) even after getting nod from the ministry.

“The letters would be dispatched on Sunday to the companies to remind them to go public or they would have to face new rules and regulations,” BIA Chairman Sheikh Kabir Hossain told the FE.

A long tussle between insurers and its regulator over floating initial public offering (IPO) by those companies came to an end as Ministry of Finance (MoF) intervened into the matter in reply to several pleas from the insurers, said a BIA official.

Earlier, a tripartite meeting among insurers, IDRA and the government was held July 28 at the finance ministry with Banking Division secretary Shafiqur Rahman Patwary in the chair.

The meeting decided in principle that the 14 insurance companies would float shares under old laws and regulations, said a BIA official attended at the meeting.

On August 9, Finance Minister AMA Muhith approved a proposal of Banking and Financial Institution Division, MoF, in this respect. The Division on the same day directed SEC to act as per the latest directives.

“But those 14 insurance companies have not yet applied to SEC under the new directives. The letter is a warning to them to float shares as soon as possible,” Sheikh Kabir Hossain told the FE.

On September 19, insurers met with parliamentary standing committee on the finance ministry. The JS body said all the insurance companies to come to stock market. “If they could not come into the market they have to comply with new rules and regulations,” said a meeting source.

Both SEC and Insurance Development and Regulatory Authority (IDRA) refused to accept the IPOs of insurance companies concerned several times since February, this year for their failure to meet the enhanced paid-up capital, he said.

Under the new insurance act of 2010, insurance companies need Tk 300 million and Tk 400 million paid-up capital for life and non-life insurance companies respectively to float IPOs.

But those 14 insurance companies can apply as per earlier requirements, be it life or non-life, at Tk 75 million minimum paid-up capital for an insurance company to float IPO.

Among the 14, eight non-life companies are — Meghna Insurance, Bangladesh National Insurance, South Asia Insurance, Islami Commercial Insurance, Express Insurance, Crystal Insurance, Union Insurance and Desh Insurance.

The six life insurance companies are — Homeland, Sunflower, Padma, Sunlife, BAIRA and Golden Life Insurance Company.

At present, a total of 44 insurance companies with 504,819,653 shares are listed with the Dhaka Stock Exchange (DSE).

Author : Ismail Hossain