Facebook will pay a fee of just 1.1 percent to underwriters of its initial public offering, a source with knowledge of the company’s plans said on Monday.

Facebook will pay a fee of just 1.1 percent to underwriters of its initial public offering, a source with knowledge of the company’s plans said on Monday.

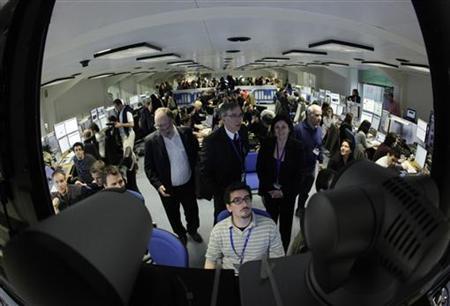

News that the payout would be much slimmer than the typical underwriting fee came as Facebook executives highlighted the engagement of its massive user base during a meeting on Monday with about 100 analysts, investment bankers and others involved in the IPO.

Sources had said the company’s underwriters would swallow a fee much lower than the 3 percent to 7 percent that is typical on Wall Street, because of the prestige of being associated with Silicon Valley’s largest ever IPO, as well as the promise of being bankers in future to the world’s largest social network.

Facebook’s underwriters include Morgan Stanley, J.P. Morgan, Goldman Sachs, Bank of America, Barclays and Allen & Co. Earlier this month, the company also named an additional 25 banks as underwriters.

Analysts and investment bankers from many of these firms attended a meeting with Facebook executives at the company’s headquarters which lasted about three-and-a-half hours on Monday, according to two sources who attended.

Facebook Chief Executive Mark Zuckerberg did not attend, but most of the company’s other top management made presentations at the meeting, including Chief Operating Officer Sheryl Sandberg, Chief Financial Officer David Ebersman, head of product Chris Cox and vice president of engineering Mike Schroepfer, according to the people in attendance.

Facebook declined to comment.

One of the attendees described the meeting as a useful opportunity for Wall Street analysts and bankers to meet various executives at Facebook, but said there was little new information shared about Facebook’s business or operations.

“It was a good first step for establishing a relationship,” said the attendee, noting that Facebook invited the guests back for a second meeting in April to go over its business in more detail.

NO GUIDANCE GIVEN

The attendees, who were treated to a “very basic” breakfast spread, “the same as you’d expect at a Holiday Inn,” did not want to be identified because they agreed not to discuss the meeting publicly.

Facebook, the world’s No.1 social network with more than 845 million users, held the meeting at its new corporate home base in Menlo Park, California.

The company, which is competing with established Web giants such as Google Inc and Yahoo Inc for online advertising, is preparing to raise $5 billion in a closely-watched IPO that could value the company at between $75 billion and $100 billion.

Facebook discussed the number of daily and monthly active users on Facebook and highlighted levels of engagement. It did not give any guidance, another attendee said.

Analysts asked about 30 questions and some of those focused on how Facebook may make money from its large user base in the future. Facebook did not provide much information on future monetization plans, the person added.

The company also highlighted recent litigation by Yahoo and said that it would be filing a response soon, the person added. Ted Ullyot, Facebook’s top attorney, was also at the meeting.

Facebook discussed how it buys components to build computer servers itself to save money, the person said.

News of the 1.1 percent IPO fee was reported earlier by Bloomberg.

While IPOs which raise less than $500 million typically generate underwriting fees of 7 percent, the fee percentage shrinks as an IPO grows in size.

Social game maker Zynga, which raised $1 billion in a December IPO, generated fees of roughly 3 percent for bankers.

Source : Reuters